Michelle Hamilton long worked for Hewlett-Packard but after being laid-off prior to the pandemic, she has focused her energy on establishing a tax on fossil fuels.

As the leader of the Reno-Sparks chapter of the Citizens’ Climate Lobby, a nationwide nonprofit which focuses on creating the political will for environmental progress, Michelle Hamilton brings energy, dedication, and innovation to addressing climate change.

“It’s been around since 2010 as a national organization,” explained Hamilton, “and there are three chapters in the Nevada area.” Along with the chapter locally, there are chapters in Carson City and Las Vegas. The Reno chapter was established in 2015 and all three chapters focus on lobbying politicians, influencers and stakeholders to advocate for climate change legislation.

“We do that through many vehicles, one is meeting directly with members of Congress,” said Hamilton “to help them understand the climate legislation that we’re advocating for.” The local chapters also focus on outreach to community leaders and business owners. Their goal is to start the conversation and amplify the discussion around climate change and a possible carbon tax.

The Energy and Innovation Carbon Dividend Act of 2021 was introduced into the U.S. House of Representatives in April by one of Florida’s Representatives Ted Deutch, along with 28 original cosponsors, which has since climbed to over 50 sponsors. According to a statement released by Deutch “it would ensure that polluters pay a rising cost for their emissions, driving down greenhouse gas pollution and returning the proceeds to taxpayers every month. This important legislation will be a crucial tool in our country's urgent fight against the climate crisis.”

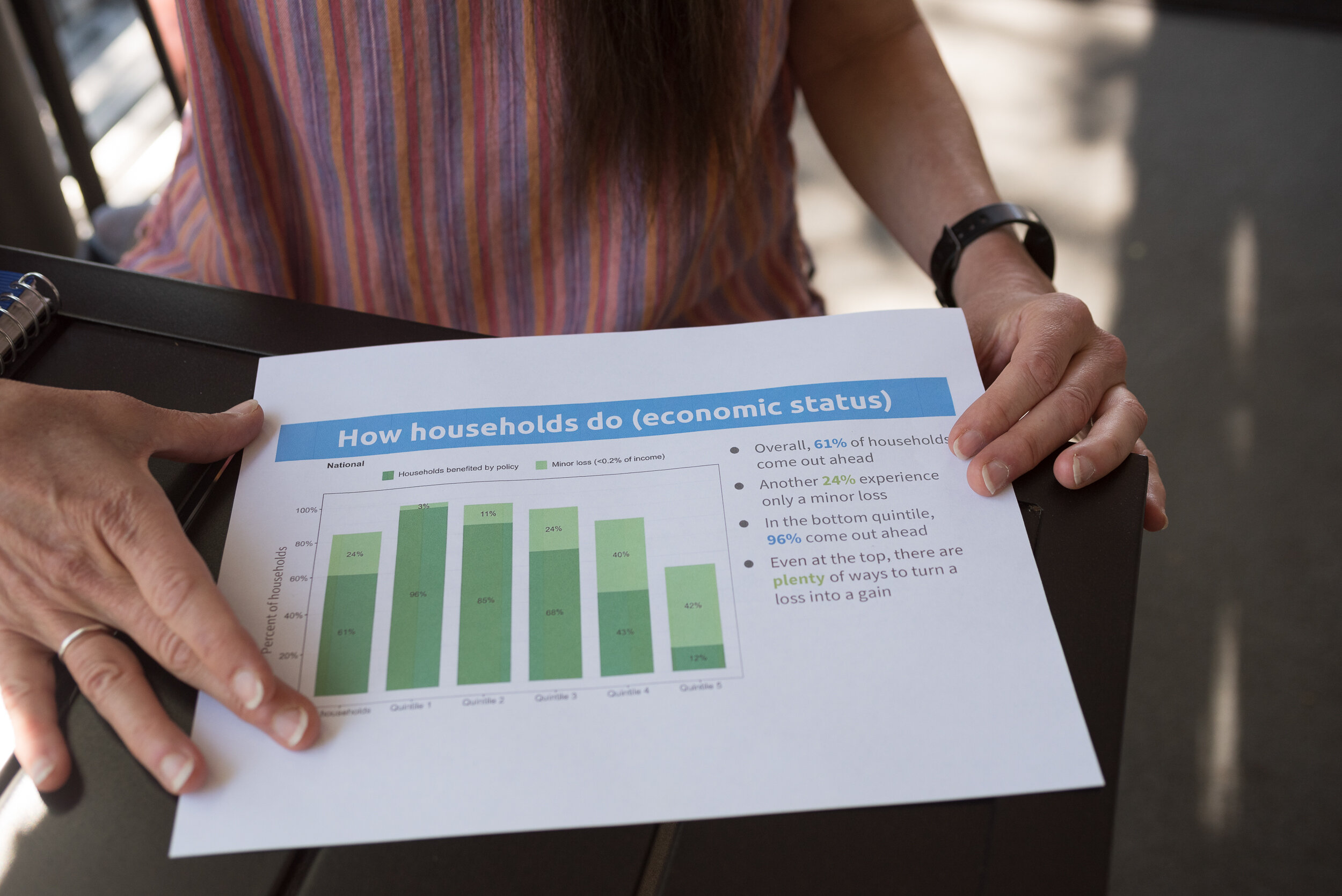

Hamilton explained the dividend would put more money into the pockets of the majority of the population while also encouraging those that create the most carbon to reduce their emissions.

Seeking Local Support for a Federal Initiative

“We would love for Rep. Mark Amodei to sign on as a cosponsor of this important bill,” said Betsy Fadali in a recent press release. She is also a member of the local Citizen Climate Lobby. The bill would put a $15 tax per ton on oil, natural gas, and coal.

“A well-designed carbon tax is going to do a number of things,” explained Hamilton. “First it’s going to place a fee on fossil fuels at the point of extraction.” She identified this as the coal mines, the wellheads, the point of production, or where these resources leave the earth. The advantage of this, Hamilton explained, is putting a tax on pollution. “By putting a tax on carbon, what you’re fundamentally doing is discouraging the burning of fossil fuels,” elaborated Hamilton.

Opponents of the bill say it would increase bills for utilities and the price of many products and services. Hamilton sees it instead as reorienting money to save the planet and help most affected people. It would act like a snowball rolling down a hill, she said, slowly at first, but with time, business and individuals alike would be incentivized to reduce their carbon emissions.

“The money should be distributed on an equitable basis back to the U.S. population,” said Hamilton. The Citizen Climate Lobby feels strongly that the generated revenue should go back to the demographics most affected by fossil fuels extraction, often this is lower-income families and people of color.

“The dividend is going to give them more money than what they’re facing in increased cost of gas, increased cost of heating oil...and let’s not forget air conditioning,” emphasized Hamilton. She further explained that the vast majority of households in the bottom 20% economic bracket, or “the people who have the least will also come out ahead.”

Another benefit to a carbon tax she said would be to start shifting the focus from production to innovation. Companies that have a fleet of vehicles may start to shift the fleet over to electric vehicles, as fuel costs continue to climb. The fossil fuel producers will have to shift their focus in order to remain viable. This tax also has the potential, she explained, to begin slowing the amount of oil and fuel consumed across the nation and buy time to develop new technology and transition to sustainable energy.

“As soon as we change that and polluting is no longer free,” said Hamilton “then those costs are going to be embedded in the cost of the products.” This will give the average person buying power into making rational choices into how they contribute to climate change; which is often seen as an overwhelming dilemma with little but nothing to do, a carbon tax like this will begin to shift the narrative and empower the individual consumer.

Hamilton did say the biggest drawback of this carbon tax and legislation would be that it is not a silver bullet and has its faults. Notably, it excludes all farming vehicles from being taxed. “On a larger scale, the legislation doesn’t address the land use,” explained Hamilton “whether or not we plant forest, whether or not we cut them down, that’s going to have an impact on greenhouse gas emissions.” She said the bill does not address how agriculture addresses carbon sinking, or the storage of carbon in the soil or carbon emitting, which elevates greenhouse gasses.

“A lot of people are concerned about climate change,” Hamilton said. “At the heart of it I really believe people are nice.” She is excited about the traction this bill has garnered in Congress and remains optimistic. She encourages the community to talk about climate change. To simply have a dialogue with friends and family about what can be done and how changes can be made. “Don’t be afraid to talk about this,” she encouraged. “Find out more. We don’t all have to agree but if we’re not having conversations about the things we care about...we’re not going to solve this problem unless we engage in dialogue.”